Fixed Overhead Volume Variance: Its Role and Impact in Financial Strategy and Planning

Fixed Overhead Volume Variance is necessary in the preparation of operating statement under absorption costing as it removes the arithmetic duplication as discussed earlier. Further analysis might reveal that the positive variance is a symptom of larger issues such as suboptimal sales forecasting or marketing misalignment. Conversely, a negative variance, which points to higher than expected production levels, could signal market share growth or an unexpected surge in demand. However, it could also raise concerns about overextension of resources and the potential for increased wear and tear on machinery, which could lead to higher maintenance costs or capital expenditures in the long term.

Great! The Financial Professional Will Get Back To You Soon.

Production inefficiencies, such as machine breakdowns or labor disputes, can also result in lower output than planned. Additionally, strategic decisions, like the introduction of new products or changes in product mix, can alter production volumes and impact the variance. It is important for businesses to analyze these factors thoroughly to understand the causes of variances and to implement measures to optimize production processes and capacity utilization. Being fixed within a certain range of activity, fixed overhead costs are relatively easy to predict. Because of the simplicity of prediction, some companies create a fixed overhead allocation rate that they continue to use throughout the year. This allocation rate is the expected monthly amount of fixed overhead costs, divided by the number of units produced (or some similar measure of activity level).

Do you own a business?

A company budgets for the allocation of $25,000 of fixed overhead costs to produced goods at the rate of $50 per unit produced, with the expectation that 500 units will be produced. However, the actual number of units produced is 600, so a total of $30,000 of fixed overhead costs are allocated. This factory overhead cost budget starts with the number of units that could be produced at normal operating capacity, which in this case is 10,000 units. Total variable factory overhead costs are $50,000, and total fixed factory overhead costs are $70,000.

Fixed Overhead Variance Journal Entry

The variance is adverse because Motors PLC utilized more manufacturing hours in the production of 275,000 units than the standard. The variance is favorable because Motors PLC managed to operate more manufacturing hours than anticipated in the budget. This implies that the difference between budgeted and flexed fixed cost is included twice in the operating statement.

For simplicity assume that there was no fixed overhead expenditure variance, that is that actual overhead expenditure was as budgeted. Estimate the total number of standard direct labor the issuance of common stock hours that are needed to manufacture your products during 2023. Budget or spending variance is the difference between the budget and the actual cost for the actual hours of operation.

Fixed Overhead Variances in Cost Accounting

Fixed overhead expenditure variance is the difference between the budgeted fixed overhead expenditure and actual fixed overhead expenditure. In this example, the fixed overhead budget variance is positive (2,000 favorable), and the fixed overhead volume variance is negative (-1,040 unfavorable), resulting in an overall positive overhead variance (960 favorable). This variance would be posted as a credit to the fixed overhead budget variance account.

Factory overhead costs are also analyzed for variances from standards, but the process is a bit different than for direct materials or direct labor. The first step is to break out factory overhead costs into their fixed and variable components, as shown in the following factory overhead cost budget. In its New Jersey factory, the company budgets for the allocation of $75,000 of fixed overhead costs to produce the tiles at a rate of $25 per unit produced.

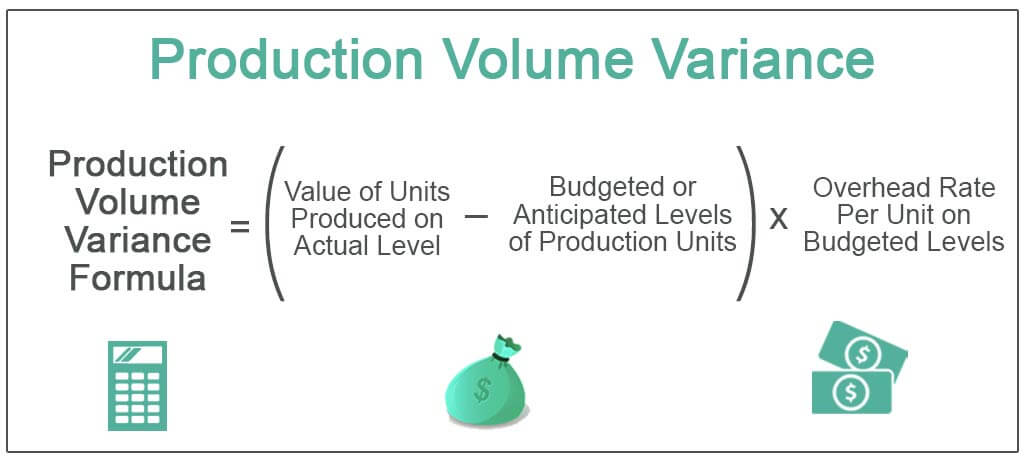

If the actual production volume is higher than the budgeted production, the fixed overhead volume variance is favorable. On the other hand, if the actual production volume is lower than the budgeted one, the variance is unfavorable. In standard costing systems where overheads are absorbed on direct labour hours, companies sometimes analyse the fixed overhead volume variance into capacity and volume efficiency elements. The traditional calculation of sub-variances (i.e. fixed overhead capacity and efficiency variances) does not provide a meaningful analysis of fixed production overheads.

- If 11,000 units are produced (pushing beyond normal operational capacity) and each requires one direct labor hour, there would be 11,000 standard hours.

- This variance would be posted as a credit to the fixed overhead budget variance account.

- Together the capacity and volume efficiency variance sum to the fixed overhead volume variance.

- By integrating this variance into financial reports, analysts can provide a comprehensive overview of how effectively a company is leveraging its production capacity.

This benchmarking process can reveal whether a company is maintaining a competitive edge in terms of cost efficiency and capacity utilization. A similar approach may be used to understand standard costing fixed overhead variances. You simply need to remember that an over absorption of overhead is equivalent to a favourable variance (because it is added back to profit) and by similar logic an under absorption of overhead is equivalent to an adverse variance. The fixed manufacturing overhead volume variance is the difference between the amount of fixed manufacturing overhead budgeted to the amount that was applied to (or absorbed by) the good output. If the amount applied is less than the amount budgeted, there is an unfavorable volume variance.

It may appear strange to you that even though the absorbed fixed overheads are higher than the budgeted overheads, the variance is described as being ‘favorable’ which is usually not how cost variances are interpreted. In short, this variance is used as a balancing exercise when fixed overhead expenditure variance is calculated. Changes in market demand can lead to fluctuations in production volume, thereby affecting the variance.

Leave a Reply

You must be logged in to post a comment.