Closing Entries in Accounting: Everything You Need to Know +How to Post Them

Any account listed on the balance sheet is a permanent account, barring paid dividends. On the balance sheet, $75 of cash held today is still valued at $75 next year, even if it is not spent. They are special entries posted at the end of an accounting period. These accounts are be zeroed and their balance should be transferred to permanent accounts. The month-end close is when a business collects financial accounting information. Using the above steps, let’s go through an example of what the closing entry process may look like.

Closing Entries, With Examples

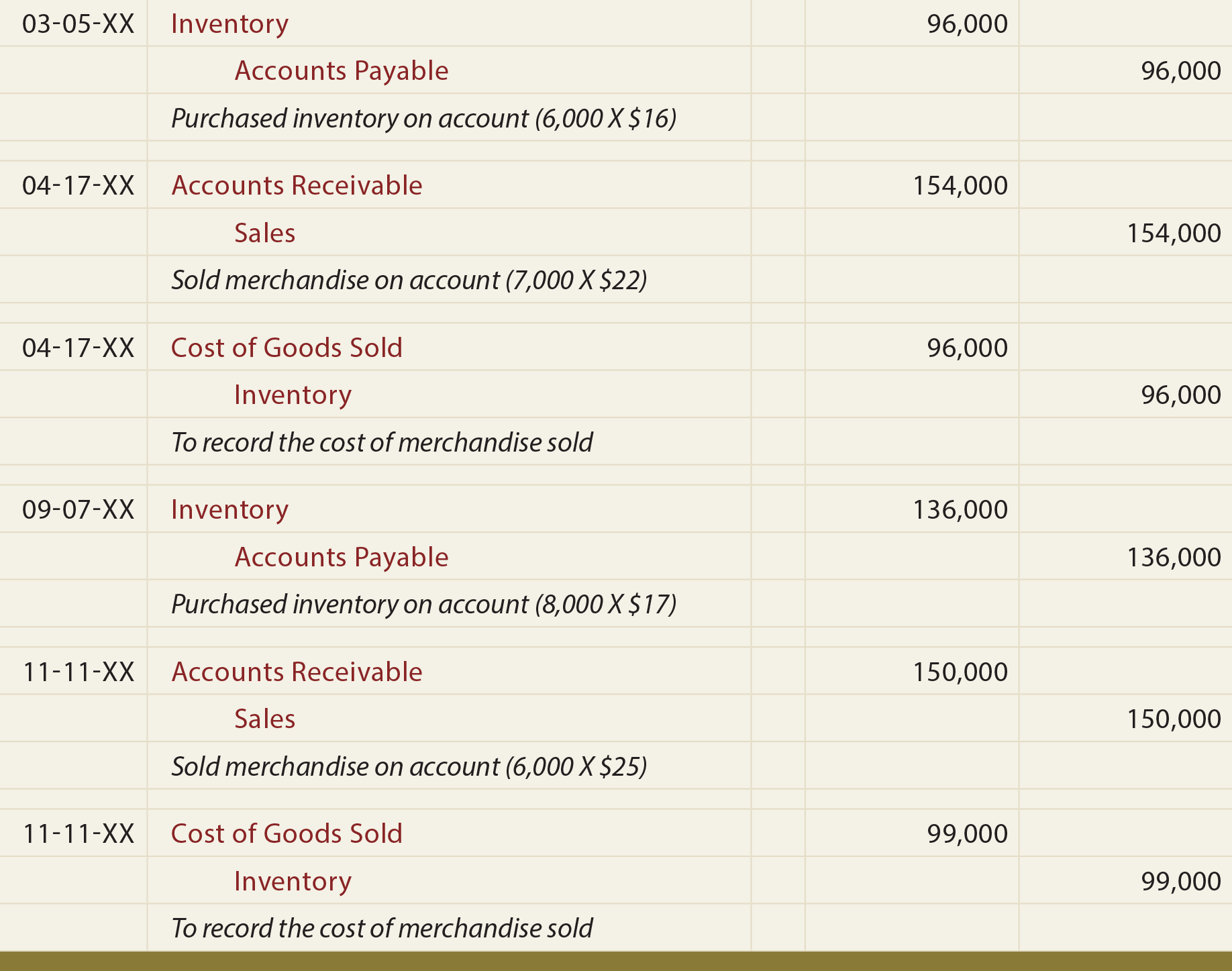

Printing Plus has $140 of interest revenue and $10,100 of service revenue, each with a credit balance on the adjusted trial balance. The closing entry will debit both interest revenue and service revenue, and credit Income Summary. The first entry closes revenue accounts to the Income Summary account. The second entry closes expense accounts to the Income Summary account.

Temporary and Permanent Accounts

To get a zero balance in an expense account, the entry will show a credit to expenses and a debit to Income Summary. Printing Plus has $100 of supplies expense, $75 of depreciation expense–equipment, $5,100 of salaries expense, and $300 of utility expense, each with a debit balance on the adjusted trial balance. The closing entry will credit Supplies Expense, Depreciation Expense–Equipment, Salaries Expense, and Utility Expense, and debit Income Summary. Closing entries are a fundamental part of accounting, essential for resetting temporary accounts and ensuring accurate financial records for the next period. This process highlights a company’s financial performance and position. In this guide, we delve into what closing entries are, including examples, the process of journalizing and posting them, and their significance in financial management.

Step #2: Close Expense Accounts

- They’re housed on the balance sheet, a section of financial statements that gives investors an indication of a company’s value including its assets and liabilities.

- The closing entry will credit Supplies Expense, Depreciation Expense–Equipment, Salaries Expense, and Utility Expense, and debit Income Summary.

- In this example, it is assumed that there is just one expense account.

- This process highlights a company’s financial performance and position.

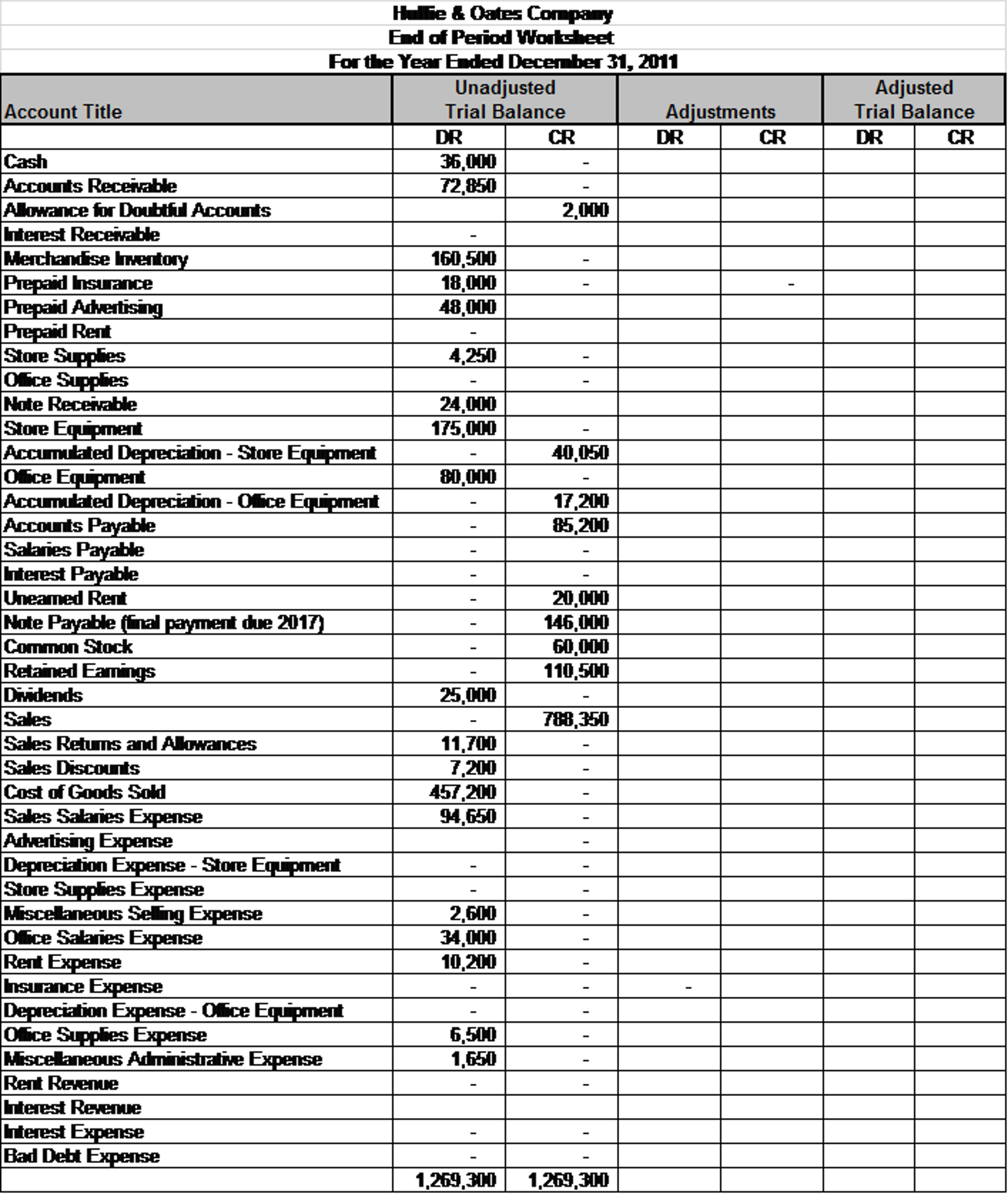

” Could we just close out revenues and expensesdirectly into retained earnings and not have this extra temporaryaccount? We could do this, but by having the Income Summaryaccount, you get a balance for net income a second time. This givesyou the balance to compare to the income statement, and allows youto double check that all income statement accounts are closed andhave correct amounts. If you put the revenues and expenses directlyinto retained earnings, you will not see that check figure. Nomatter which way you choose to close, the same final balance is inretained earnings. We see from the adjusted trial balance that our revenue accounts have a credit balance.

What is an income summary account?

LiveCube Task Automation is designed to automate repetitive tasks, improve efficiency, and facilitate real-time collaboration across teams. By leveraging advanced workflow management, the no-code platform, LiveCube ensures that all closing tasks are completed on time and accurately, reducing the manual effort and the risk of errors. Organizations can achieve a 40% increase in close productivity, resulting in a more streamlined financial close process and allowing your team to focus on more strategic activities. With the use of modern accounting software, this process often takes place automatically. That’s why most business owners avoid the struggle by investing in cloud accounting software instead. An accounting year-end which is not the calendar year end is sometimes referred to as a fiscal year end.

Revenue and expense accounts are closed to Income Summary, and Income Summary and Dividends are closed to the permanent account, Retained Earnings. It is permanent because it is not closed at the end of each accounting period. At the start of the new accounting period, the closing balance from the previous accounting period is brought forward and becomes the new opening balance on the account. Other than the retained earnings account, closing journal entries do not affect permanent accounts. The statement of retained earnings shows the period-endingretained earnings after the closing entries have been posted.

You can close your books, manage your accounting cycle, issue invoices, pay back vendor bills, and so much more, from any device with an internet connection, just by downloading the Deskera mobile app. Lastly, if we’re dealing with a company that distributes dividends, we have to transfer big data and analytics these dividends directly to retained earnings. For partnerships, each partners’ capital account will be credited based on the agreement of the partnership (for example, 50% to Partner A, 30% to B, and 20% to C). For corporations, Income Summary is closed entirely to “Retained Earnings”.

Temporary accounts can be found on the income statement, while permanent accounts are located on the balance sheet. On the statement of retained earnings, we reported the ending balance of retained earnings to be $15,190. We need to do the closing entries to make them match and zero out the temporary accounts. The next step is to repeat the same process for your business’s expenses. All expenses can be closed out by crediting the expense accounts and debiting the income summary. At the end of a financial period, businesses will go through the process of detailing their revenue and expenses.

Leave a Reply

You must be logged in to post a comment.